Trusted Colorado Estate Planning & Tax Attorney

Leonard Parker is a highly recommended estate planner and an expert in tax resolution matters. Mr. Parker’s tax advisory services function to support both individuals and small businesses to achieve their financial goals and protect their best interests. Whether you own a small or corporate business, if you require a corporate tax return consultant or assistance planning for future taxes, Mr. Parker’s extensive experience will significantly benefit you. His background includes all aspects of small business accounting, tax and finance planning, business valuation, and more. Further, Leonard K. Parker offers individual tax return services and personal financial planning services. Thus, you can count on him to provide quality technical expertise and personalized service for your unique accounting needs. This includes retirement planning, investment planning and management, creditor protection, and more.

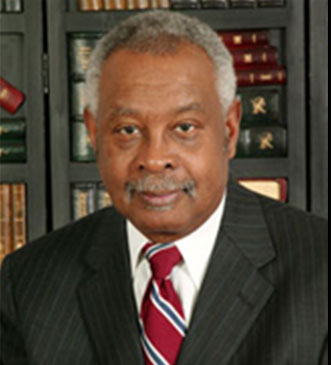

Meet Leonard K. Parker

Leonard K. Parker

Leonard K. Parker, Certified Public Accountant has been practicing public accounting for fifteen years. His goal has been to provide his clients with the highest level of technical expertise with personalized service.

Your Most Valuable Business Asset may be the accounting services you receive. Whether your business needs are simple or complex, my firm has the full working knowledge of tax laws to serve all your accounting needs from tax planning to financial accounting to long-term planning.

An often-overlooked aspect of operating a business is the benefit of utilizing expert accounting services to optimize your tax plans and reach your financial goals. Believe it or not, your most valuable business asset may be the accounting services you receive. Whether your business needs are simple or complex, my accounting firm has extensive experience and knowledge surrounding tax laws in Colorado. Just as we have done successfully for over fifteen years, we are proud to fulfill your accounting needs. From tax planning to financial accounting to long-term planning, our firm offers businesses and individuals a wide range of support services.

Leonard K. Parker, Certified Public Accountant, firmly believes that you are part of the boom reshaping American attitudes towards small business and personal assets. The increased sophistication and expanding need for information, capital, and systems to manage them are staggering. This boom in the small business sector has created a sizable gap in the range of accounting services available. In addition, individuals and businesses have had to sacrifice access to client-centered professional services. Due to the evident lack of client-focused services available, my accounting firm concentrates on helping smaller businesses grow and become more effective. We desire that our clients experience the personalized one-on-one accounting service they perhaps once had.

Thus, the mission of Leonard K. Parker is to offer value and efficiency to clients. We aim to enhance business performances by providing timely, professional, personalized services and translating our expertise and insight into progressive solutions and opportunities.

Business-related services offered at Leonard Parker in Denver, CO, include but may not be limited to:

- Business valuation services - Determining the overall value of a business.

- Establishing internal controls - Creating efficient and safe internal channels for procedures and transactions. This process includes designating duties, documenting policies, reviewing operations, and more.

- New business formation - Develop a business plan, structuring your new operation efficiently and securely. This includes many details from developing partnerships, getting insured, creating procedures for handling resources, filing for any necessary permits, and much more.

- Tax preparation for sole proprietors - Preparing forms, calculating accurately, identifying all deductions, and more.

- Tax planning - Expert advice on optimizing your tax strategy for the future.

There are many reasons for hiring an accountant. An accountant’s tax resolution services can help you take full advantage of your financial options and become aware of legal routes that may benefit you. A few common reasons for hiring a tax accountant include retirement planning, college planning, fiduciary accounting, insurance assessments, and investment planning.

Retirement planning is generally the process of forming income goals for retirement. A successful retirement requires many steps, including examining investments, resolving debts, setting up a will or trust, and possibly much more, depending on our client's needs.

Estate planning is a vital component of any retirement plan. Meeting with an estate taxes consultant for estate planning is significantly helpful for minimizing taxes, preserving assets, or securing the future of your loved ones. Estate planning is also complex and highly worth consulting an expert over. If you require financial support near Denver, CO, Leonard Parker is available for consultation. Leonard Parker understands that by taking the time to understand your interests and the dynamics of your estate, we can best preserve your estate plan.

Although it may be daunting to consider, planning for death is ultimately the final action you will take for your loved ones, assets, or business. It's an opportunity to make sure your property and accounts are handled exactly how you prefer. Thus, another practical reason to work with an estate planning service is to protect your interests upon passing away. If you pass away without allocating your assets, your assets will be issued following the default court rulings. By utilizing professional estate planning services, you can rest assured that your intentions will be honored.

You may have questions about what is necessary to include in your estate plan. Perhaps you don't know if there are any additional steps you can take to protect your family. Or maybe you would benefit from a revision of your current plan to identify and correct any red flags.

Among the many additional reasons to consult Leonard Parker, filing a tax return with an accountant is a huge benefit for individuals as well. Since an accountant is familiar with tax law, we can ensure that your IRS filings are optimized and fully compliant with tax rules and regulations. An individual tax return professional will also protect you if you have been notified of an audit by the IRS. We can communicate with a tax agency for you and help with negotiating settlement amounts. It's best to have us on your side so that you don't end up overpaying. No matter what reason you have for hiring an accountant. Leonard Parker is an excellent representative for anyone wanting to grow towards their long-term financial goals.

Read MoreClient Testimonials

“Amazing and professional Accountant. He is very informative and works hard for every single client.

Highly recommended.”

How To Find Us?

Address: 3650 South Yosemite Street, Suite 206, Denver, CO 80237

Phone: (303) 667-3489 (Call For A Consultation)

Office Hours:

Monday - Friday (8am - 5pm)

Saturday - Sunday (Closed)

Schedule A Consultation

Fill Out The Form Below To Get In Touch!

Leonard Parker Will Help You Grow

Leonard Parker stands out from other accounting services in more ways than one. However, our most significant strength comes from our drive to help small businesses and individuals grow. We accomplish this with a wide range of accounting services that answer important financial questions such as:

- How do I lower my income taxes?

- How do I run a business to be more profitable, increase cash flow, achieve my goals, minimize debt, or get out of debt altogether?

- How do I know when I have sufficient assets for expansion, retirement, and other goals?

- What strategic partnerships might benefit my business?

- What other questions should I ask to reach my financial goals?

Call Our Experienced Denver Estate Planning & Tax Accounting Attorney

Since every decision you make today impacts your long-term goals, it’s critical to act soon. There are very few sources for individualized financial information. As part of my personalized, one-on-one service, I can guarantee the following:

- Your phone calls will likely be returned on the same day.

- Upon receiving your information, your financial statements will be returned within ten business days.

- Your tax returns and other compliance forms will be completed by or before the promised date.

- Your taxes will always be projected ahead of time, and you will be advised on how to reduce your taxes in advance.